Money-Saving Challenge: 30 Types For Every Personality in 2022: There are many budgeting strategies to choose from when it comes to saving money, whether it’s for a short-term goal, such as a trip, or a long-term goal, such as a retirement fund. Starting a money-saving challenge can be a good way to save money while being motivated to reach a goal and have fun.

However, not all challenges are appropriate for every money personality type. Whether you’re a self-motivated worker, an experience seeker, a challenge expert, or a flexible explorer, this comprehensive guide will teach you which budgeting challenges are best for your personality. Let the games begin! Money-Saving Challenges for Serious Stewards Money-Saving Challenges for Wealth Creators Money-Saving Challenges for Astute Analysts Money-Saving Challenges for Daring Explorers

What Is a Money-Saving Challenge?

Money-saving challenges are budgeting challenges that encourage spenders to achieve a specific financial goal in an innovative way. Money challenges can help you keep track of your spending and set small, achievable goals, whether it’s saving big or changing a financial habit.

Saving challenges are not only enjoyable, but they also help you establish a consistent saving habit, learn about your financial goals, track your budget, and improve your personal finances.

How to Choose a Money-Saving Challenge

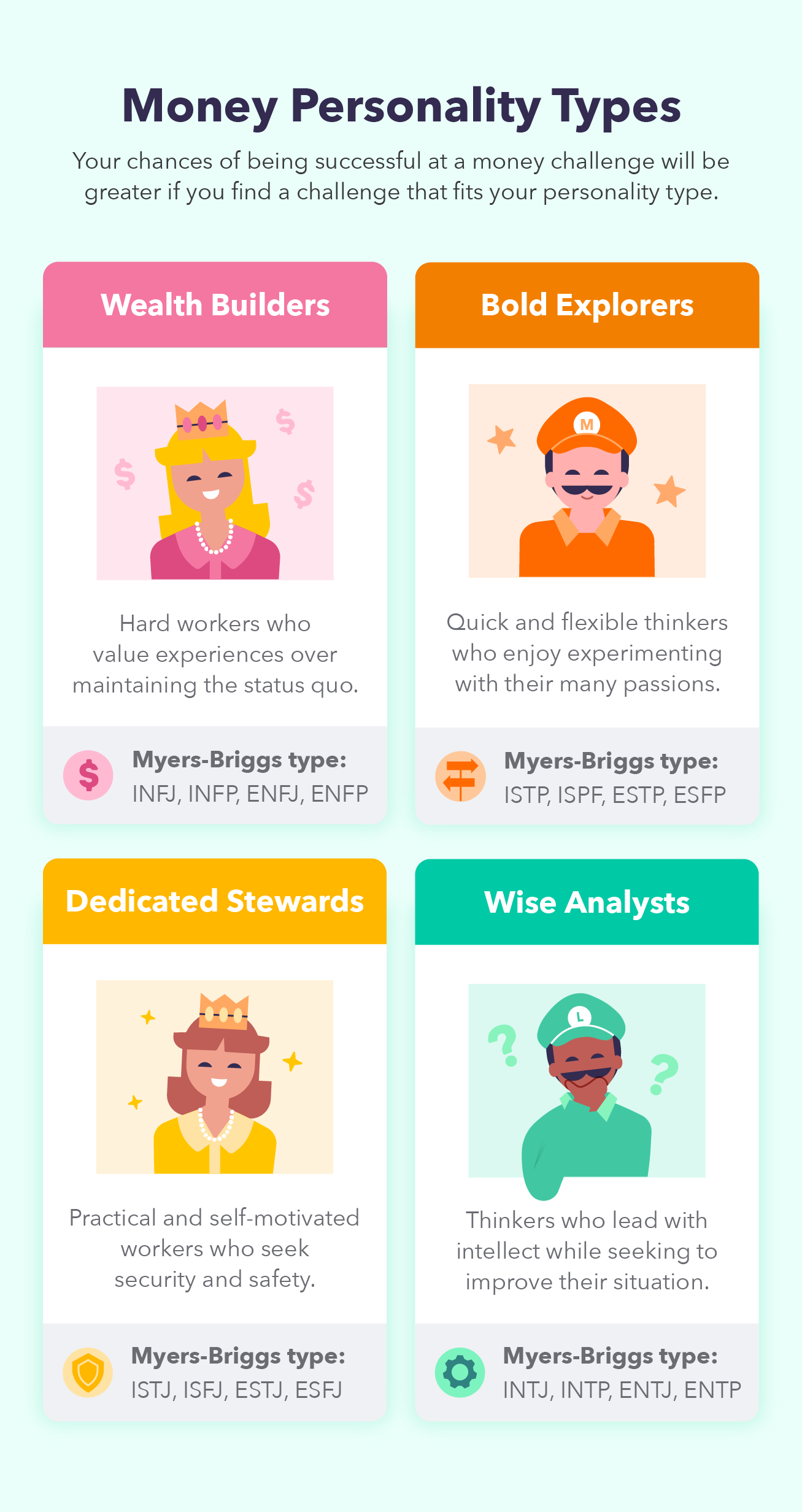

There are numerous money-saving challenges available online, but choosing one that fits your budget goals and lifestyle is critical. Choosing a challenge that corresponds to your personality type can also make it easier to complete and achieve your financial objectives.

Taking a personality test like the Myers-Briggs 16 MBTI types will help you figure out what type of person you are.

Once you’ve determined your Myers-Briggs type, consult Mint’s money personality guide to determine your money personality type:

Stewardship Dedicated

An astute observer

Wealth Creator Daring Explorer

The next step is to determine your financial objectives. Examine your living expenses and current savings to determine how much money you want to save and how much time you have.

Finally, use our guide, divided by personality type, to find a challenge that fits your personality and your saving goals. You can always choose a challenge from another personality type if you believe it is more aligned with your goals.

Money-Saving Tasks for Serious Stewards

Dedicated Stewards are self-motivated and practical workers who seek security and safety. They take risks on occasion and prefer to set smaller and more realistic financial goals and plan for the future and the unexpected. Dedicated Stewards have the following Myers-Briggs personality types:

The Analyst (ISTJ)

ESTJ: The Organizer ISFJ: The Protector

The Supporter 1. ESFJ 52-Week Money Challenge

If you want to start with a simple challenge, the 52-Week Money Challenge is flexible and doesn’t require much money or effort. After 52 weeks, you should have saved $1,378 by depositing an increasing amount of money each week. The weekly dollar amount you save corresponds to the week of your challenge.

2. Maintain the Change Challenge

When you pull out some spare change from your pocket, it’s always a pleasant surprise. But what if you could see everything in one place? Keep extra cash in a jar whenever you find it around the house or when you get a change from a store. Every penny is essential!

3. Cash-Only Challenge for a Month

Are you constantly tempted to buy things you can’t afford? Join this monthly savings challenge by carrying only cash with you when you go shopping, allowing you to spend only what you have on hand. Just don’t use this as an excuse to spend your entire paycheck.

4. Savings Challenge for 26 Weeks

If you are paid biweekly, this challenge can help you match your paycheck to your savings goals. In this money-saving challenge, you’ll save in $3 increments, beginning with $3 the first week, $6 the second, $9 the third, and so on. Transfer the corresponding amount to your savings account with each paycheck until you reach week 26 when you’ll deposit $78 for a total of $1,053.

5th. This is a challenge to save every penny you can.

This is the money challenge for those who still want to pay with cash, but you don’t have to be one to take part. It’s a lot like the Keep All the Change Challenge, except you’ll only be adding pennies to your jar. Seeing the jar fill up will show that every penny counts, and you can put it all to your savings when it’s about to overflow.

6. Minimalist Lifestyle 30-Day Challenge

If you frequently find yourself falling down the rabbit hole of minimalist lifestyle videos and don’t know where to begin, take the 30-Day Minimalist Lifestyle Challenge to motivate you to change your lifestyle while de-stressing and saving money. Follow the minimalist lifestyle tips and begin practising minimalism for 30 days to help you build better money habits.

7. Save a $1 bill challenge

Do you like the envelope budgeting method? Add another envelope to your collection and participate in this challenge to use it for something fun at the end of the year. This challenge is simple: whenever you receive a $1 bill as change, place it in your envelope for extra savings. If you’d instead save paper or an envelope, you can put it in a savings jar or piggy bank.

Wealth Builders’ Money-Saving Challenges

Wealth Builders are easily inspired and prefer new experiences to the status quo. They like to celebrate small victories and connect financial goals to their financial values. They don’t spend a lot of time analysing and instead prefer to plan out their next steps. Wealth Builders have the following Myers-Briggs personality types:

The Visionary (INFJ)

INFP: The Assistive Type

ENFP: The Dreamer ENFJ: The Leader

Challenge for Holiday Gifts

Wouldn’t it be great if Santa bought everything on our wish list? If you’re having trouble finding funds to buy gifts for your family at the end of the year, make it a goal to contribute a small amount to your holiday fund every week. Tally up all of your holiday spending from the previous year at the start of the year and figure out how much you need to save each week from reaching your goal amount.

9. Pay Yourself If You Make a Financial Mistake Challenge

Everyone makes mistakes, but how much money would you have if you had to pay for everyone? This money challenge is not intended to encourage you to make mistakes. Still, you can contribute to your savings account whenever you make a financial mistake, such as making impulse purchases or paying a bill late. This challenge can be a win-win situation in which you either make fewer errors or save more money.

10. Biweekly Savings Challenge for 26 Weeks

If adding money to your savings account for a money challenge every day or every week sounds like a lot of work, you are doing it biweekly might be a better option for you. During the 26-Week Biweekly Money-Saving Challenge, you can save more money by depositing an increasing amount of money every other week. you can save $1,404 in a year. Begin with $4 the first week and $8 the following. Every two weeks, add $4 to the total until you reach $106 on week 26.

11. Money Battle Challenge

Friendly competitions can be both entertaining and motivating. If you need a friend or family member to keep you on track, challenge them to the Money Throwdown Challenge.The rules of the challenge are entirely up to you, such as seeing who can save $1,000 the quickest or who can save the most over six months the most efficiently possible. Have dinner with your challenge partner and talk about your future plans for the money you’ve earned.

Savings Fever Challenge No. 12

Are you a fan of do-it-yourself projects? You can use your imagination to make a savings thermometer in this money-saving challenge. Draw a thermometer on paper or cardboard and write your savings goal at the top. List a smaller saving goal for each temperature and colour it as you reach each target. Although no one wants a 3,000-degree fever, this is a fun and flexible challenge for any budget.

Challenge for the Holiday Helper Fund

Budgeting for the holidays can be tricky with party planning, but saving small amounts Budgeting throughout the year will make it easier to get your finances in order by December. Make it a goal to add $20 to your holiday budget fund every week or every other week until you have enough for gifts or a family vacation at the end of the year.

14th Three-Month Savings Challenge

If you’re looking for a short-term money challenge, the 3-Month Savings Challenge can help you save $1,008 in just 90 days. To participate in this challenge, set a reminder to deposit $84 each week for the next 12 weeks. Put money into a high-yield savings account on a regular basis to save time and money.

Money-Saving Tasks for Astute Analysts

Wise Analysts are motivated by thought and lead with intellect while striving to improve their situation. They enjoy establishing specific financial goals and staying on track with automatic payments while remaining patient in terms of results. In other words, they’re designed for challenges, particularly money-saving ones. Wise Analysts have the following Myers-Briggs personality types:

ENTJ: The Planner INTJ: The Strategist INTP: The Thinker

The Inventor’s ENTP 15. No Spend Challenge

We’re all guilty of overfilling our shopping carts with items that will most likely collect dust. If you feel like you’re overspending on non-essentials, try the No Spend Challenge. You will eliminate all discretionary spending in this money-saving challenge. You can also choose which categories to avoid purchasing, such as clothing or takeout.

16. Nickel-Saving Challenge for 356 Days

Prepare your large jars. This enjoyable money-saving challenge aims to save money in five-dollar increments. Begin with a nickel on day one, add two nickels the next day, then 15 cents on day three, and so on. Continue doing this until day 365, when you will deposit $18.40 into your jar. If a nickel doesn’t seem like much, wait until you see how much money you’ll have saved by the end of the year, thanks to your large jar.

17. Wednesday Weather Challenge

Why not save money instead of wearing pink on Wednesdays? Every Wednesday in this savings challenge, you’ll deposit money into your savings account — but there’s a catch. Check the weather channel for the highest local temperature and add that amount to your savings before adding money. Wearing your pink outfit when it’s 83 degrees outside is even more appealing when you’re saving $83.

18. Cut 1% of Your Salary Challenge

As frightening as it may sound, cutting 1% of your salary does not imply working for less. This budgeting challenge applies to all budgets and can be an excellent way to save money. Calculate one per cent of your annual salary and look for ways to reduce your spending by that amount. Look at your subscription services or grocery bills, for example, and see if you can reduce your budget so that you end up with 1% of your salary as a bonus.

19. Money-Saving Round-Up Challenge

Have you ever wondered why prices usually end in.99,79, or.88? It’s a psychological trick to make the price appear lower. If you enjoy saving, use this strategy to participate in the Round-Up Money Challenge by rounding up to the nearest dollar and adding those cents to your savings. For example, if you buy something for $2.79, round it to $3 and save $0.21. Some banks will allow you to do so, but some apps simplify it.

20. Meal Planning Challenge for 30 Days

Beginning with small steps can make it easier to develop positive habits. As part of this challenge, plan your meals for 30 days and have your meals packed for each day of the week if you want to reduce your grocery bills and the number of times you eat out. At the end of this budgeting challenge, compare your savings to a previous month when you ate out more frequently, and use the difference as motivation to continue the challenge in the coming months.

21. Expense Tracking Test

If you’re having trouble keeping track of your expenses, this challenge will help you develop a habit of tracking them so you can become more financially savvy. Use this budgeting challenge to start tracking your expenses by writing them down and categorising them for at least a month. If you can stick with the challenge for more than a month, you’ll be able to see where you can cut back on expenses and save more money. The Mint app makes it simple to reach your goals with personalised insights for a foolproof way of tracking your expenses.

22. Money in 100 Envelopes Challenge

Have a stack of envelopes but no idea who to write to? That will be taken care of by this money challenge. Take 100 envelopes and number them from one to one hundred. Every day or week, take a random envelope and put money in it according to the number on the envelope, then set it aside. So, if you choose envelope 38, you must add $38 to the envelope, which will help you save $5,050 at the end of the challenge. If you still have some envelopes after completing the challenge, you can write to a friend and tell them how much money you saved.

Money-Saving Adventures for Daring Explorers

Bold Explorers are quick thinkers who enjoy experimenting with their many interests. They avoid impulse purchases and establish strict saving guidelines to commit to long-term plans. They take the time to consider big decisions to avoid indulgent purchases carefully. Bold Explorers have the following Myers-Briggs personality types:

The Experimenter (ISTP)

The Artist (ISPF)

The Risk Taker (ESTP)

The Socialite ESFP 23. Pantry Challenge

Tired of spending money on restaurants or seeing your grocery bills mount? Challenge your creativity by attempting to eat as much of the food you already have in your house as possible before purchasing more groceries. This is your chance to start meal planning and reducing waste by doing little to no shopping for extra ingredients. For this saving challenge, you might have to come up with some crazy — but still delicious! — recipes.

Challenge to Break a Bad Habit No. 24

Are you trying to break a bad habit while also saving money? This challenge addresses both issues. Whatever bad habit you have — smoking, drinking a lot of soda, or spending too much time on TikTok — could be keeping you from reaching your financial objectives. Kick your bad habits and reward yourself by putting the money you would have spent into savings instead. Just don’t spend your prize money on developing new bad habits.

The $5 Bill Savings Challenge is number 25 on the list.

Like the $1 bill challenge, this budgeting challenge will help you save money without much effort. When you get a $5 bill as change or withdraw money from the bank, save it in a safe place. Check how much you saved after a few months, or set a goal of doing it for a whole year.

26. Find Extra Money Task

If you believe you never have extra money after paying your bills, you may be looking in the wrong place. Use the Find Extra Money Challenge to get creative and search your home for any spare change you may have forgotten about. Examine every pocket on your pants and jacket, between your couch cushions, and in your junk drawer. Is your house spotless? You can make extra money for yourself by setting a goal to spend less than your budget and putting the difference in your savings account, or by decluttering your home and selling items you no longer use.

Coffee Break Challenge No. 27

Want to save money but can’t seem to cut back on your coffee runs? This savings challenge will motivate you to make your coffee at home while saving money. Whenever you make coffee at home, instead of going out, put $2.75, or the amount you would have spent on coffee, into a jar or directly into your savings account. Coffee tastes better when you save money, whether you have excellent barista skills or prefer it simple.

28. Cancellation Obstacle

Free trials are ideal when we want to watch a movie but aren’t ready to commit to a subscription. But what if you forget to cancel the trial before it expires? With the rise of subscription services, it’s easy to lose track of your spending. Participate in the Cancellation Challenge by evaluating all of your subscription services, cancelling any that you haven’t been using, and transferring the money you would have spent on them to your savings.

29. Money-Saving Challenge for 12 Weeks

If you need money to buy a gift for a family member or save for a dream vacation but don’t have a lot of time, the 12-Week Money Challenge can be an excellent place to start. In this challenge, you will begin with a $10 deposit and increase it by $10 each week. When you reach the 12th week, you will deposit $120 to complete your challenge with $780 saved up.

30. No-Eating-Out-Of-Household Challenge

Eating out can be tasty and enjoyable, and it doesn’t leave dirty dishes in your sink — but it does sully your credit card statement. If you enjoy eating out but want to save money for something else, taking on this money-saving challenge can be an excellent way to save money while brushing up on your cooking skills. Because preparing your food can be less expensive, see how long you can go without eating out or ordering takeout and enjoy the taste — and savings — of your cooking.

When Should You Begin a Money-Saving Challenge?

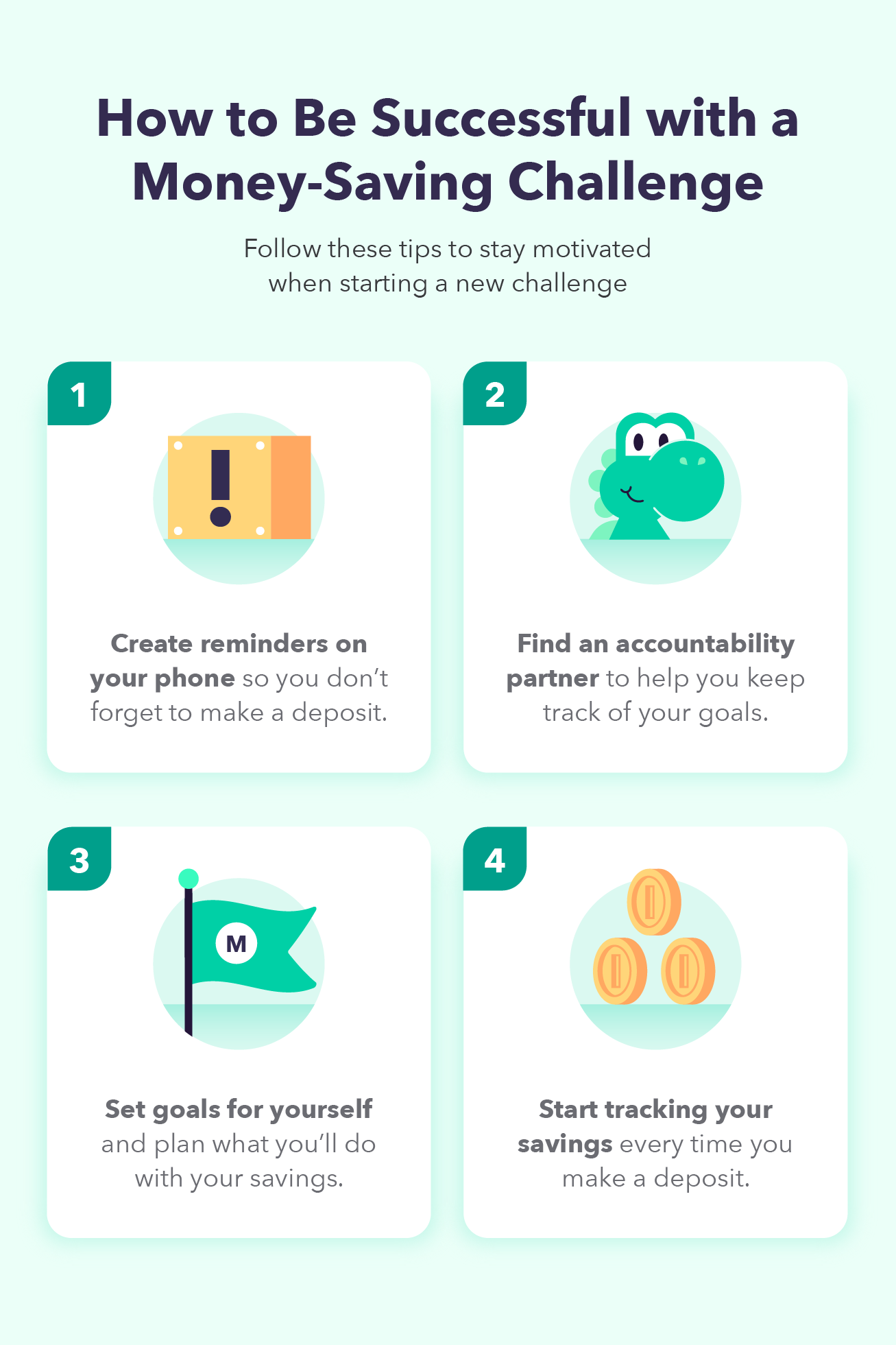

The majority of money-saving challenges do not have a predetermined starting point. Whether you choose to begin on January 1st or your birthday, tailor the challenge to your savings goals and timeline. When deciding the best time to start, consider your schedule and current savings.

The Bottom Line

Budgeting can be easier when you’re having fun. Attempting a money-saving challenge can help you get one step closer to your financial goals and help you build better-saving habits. Whether you finish a challenge or decide to try a different one, you will be able to learn more about your money personality and spending habits.

Sources: Myers-Briggs

The post Money-Saving Challenge: 30 Types For Every Personality in 2022 appeared first on MintLife Blog.

The post Money-Saving Challenge: 30 Types For Every Personality in 2022 appeared first on https://gqcentral.co.uk

Comments are closed